What are South Florida’s most depraved scams?

What is it about South Florida that makes the region such an effective hatchery for scams and schemes?

“Is it the weather? Is it because it’s beautiful and the fraudsters want to live here?” asked Kelly Jackson, top agent in the Internal Revenue Service’s criminal investigative division in South Florida, in 2015. “Is it because it’s such a melting pot and you have organized crime from all ethnic groups? Any fraud, it always seems to start here.”

Perhaps it’s just the geography. If Florida is our national drain, then South Florida is where the dregs settle.

Anonymous among both the honest and amoral, connivers can concoct their contrivances inside any obscure office or suburban home, unchecked by unfamiliar neighbors and beyond notice of preoccupied authorities.

Ultimately it’s up to us, the prey, to maintain a wary guard, lest we too be pillaged.

While by no means an exhaustive list, here are some of South Florida’s most depraved scams:

Investment fraud

Ponzi schemes. Distressed real estate schemes. Fraud involving gold and precious metals. Investment pitches via telephone. Stocks for bogus companies and nonexistent products.

No one wants to see their money compound at the same snail’s pace as their neighbor’s. That’s why so many people — especially retirees with finite resources — are willing to sign over their nest eggs to well-dressed slicksters with promises to share secret formulas for high yields.

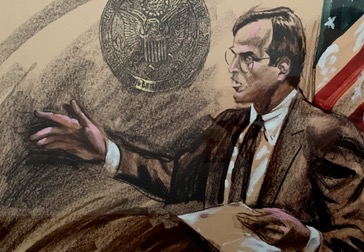

South Florida’s Ponzi scheme poster boy, Scott Rothstein, pleaded guilty in 2010 to a scheme that extracted $1.4 billion from hundreds of victims. He’s serving a 50-year sentence despite cooperating with authorities to secure the convictions of 29 of his co-conspirators. Remarkably, all of his victims received full restitution after auctions of Rothstein’s homes, jewelry, fancy cars and other bling. Most victims of investment scams aren’t as fortunate.

There are no guarantees of high investment returns, cautioned Philip J. Keating, founding president of the South Florida chapter of the nonprofit group Better Investing at a December 2014 meeting in Fort Lauderdale. Nationwide, 70 percent of investment scams could have been avoided if people would have checked what they were told, a director of the U.S. Securities and Exchange Commission said in a 2014 Sun Sentinel story. But often, people selling fraudulent investments are not licensed brokers or give false information that cannot be verified, the director said.

Potential investors should always make sure brokers are licensed and securities are registered, experts say.

Federal agents carry boxes out of an office of a drug treatment center in Delray Beach in December 2014 amid a crackdown on sober homes and treatment centers that used addicts as pawns so they could bill insurance companies for frequent drug treatment and testing services. (Joe Cavaretta / Sun Sentinel)

Federal agents carry boxes out of an office of a drug treatment center in Delray Beach in December 2014 amid a crackdown on sober homes and treatment centers that used addicts as pawns so they could bill insurance companies for frequent drug treatment and testing services. (Joe Cavaretta / Sun Sentinel)

Drug treatment/sober home fraud

Addicts are the pawns and sober homes are the pimps in this especially cynical scheme that exploits drug abusers fortunate enough to have health insurance.

A federal indictment filed in 2016 against a chain of sober homes and addiction centers in Broward and Palm Beach counties described how addicts seeking help were passed around like merchandise by the sober homes so that affiliated drug treatment centers could bill their health insurers for nonexistent treatment and unnecessary urine and saliva tests.

The sober homes lured the addicts with gifts and promises of free rent, then brokered them to one treatment center after another for daily drug testing, the federal complaint said. All the while, some of the sober houses allowed the addicts to continue using drugs on the premises so they would require continued treatment and testing services, the indictment said.

Dozens of South Florida sober homes were in on the scam, collecting tens of millions of dollars, according to news reports. The owner, Kenneth Chatman, pleaded guilty to federal charges of conspiring to commit health care fraud, money laundering and sex trafficking. He was sentenced to prison for 27½ years.

ATM and gas pump skimmers

Who doesn’t like the convenience of swiping a credit or debit card at the gas pump and avoiding the walk from the car to the store? Who hasn’t taken advantage of always-open ATM machines to withdraw cash?

Who doesn’t like the convenience of swiping a credit or debit card at the gas pump and avoiding the walk from the car to the store? Who hasn’t taken advantage of always-open ATM machines to withdraw cash?

Scammers know we like the convenience, too — and they use simple devices easily available over the internet to record debit and credit card PIN codes and other information and swindle us out of millions of dollars.

In 2016, the state Department of Agriculture and Consumer Services reported recovering more than 260 skimming devices at Florida gas stations. Of those, 38 percent were attached to gas pumps in South Florida.

Victims lose an average of $1,000 each, agency Commissioner Adam Putnam said at a news conference. “These skimming devices can be left on for weeks, even months, sometimes without detection,” he said.

ATM skimmers work similarly, with some card slots easily fitting over the top of the existing card slots and recording information off of the magnetic stripes of every inserted card.

Introduction of embedded microchips in credit and debit cards have sharply reduced fraudsters’ ability to counterfeit your cards, but with the reduction of so-called “card present” fraud have come increases in scams by hackers who have been able to get hold of account information stored online by e-commerce merchants, gizmodo.com reported in February.

Lottery and sweepstakes scams

If someone you don’t know calls you with the very good news that you’ve won big money in a lottery or sweepstakes but then says you need to send some of your own money to secure the prize, you should hang up the phone.

In the hands of a convincing fraudster, this age-old scam can be quite lucrative. Damion Bryan Barrett was in his 20s when he operated a lottery scam in Montego Bay and Broward County from late 2008 to early 2012, according to authorities.

Barrett preyed on seniors in the United States and kept detailed records of their ages, whether they were widowed, and if they had easy access to cash. He called the victims and told them they had won millions of dollars in a lottery but had to pay fees of up to several thousands to collect. Barrett raked in more than $120,000, but he was later extradited to the United States from his native Jamaica, convicted in federal court, sentenced to 46 months in prison and ordered to pay $94,456 in restitution.

Another variation of the lottery scheme begins with a con man or woman approaching a stranger with a story about having a winning lottery ticket that can’t be redeemed — usually because the “winning ticket holder” is an undocumented immigrant or something similar. The schemer is willing to split the winnings with the stranger if the stranger hands over a smaller sum of money as a sign of “good faith.”

In the words of a Delray Beach police detective in this 2008 Sun Sentinel story, “If you meet somebody one day and suddenly you’re in the bank teller line — 100 percent that’s an automatic scam.”

Fortune telling scams

Deep down, do you really believe that storefront fortune teller can predict your future? Most of the people who visit such soothsayers likely take the prognosticating with a grain of salt, while limiting the impact on their pocketbooks.

Deep down, do you really believe that storefront fortune teller can predict your future? Most of the people who visit such soothsayers likely take the prognosticating with a grain of salt, while limiting the impact on their pocketbooks.

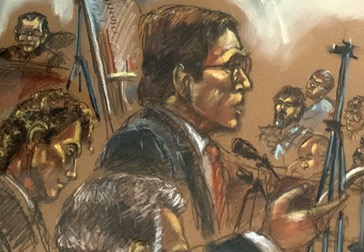

But leave it to South Florida to spawn psychic Rose Marks, who figured out how to scam 24 victims out of $17.8 million. Victims included a successful romance novelist, Jude Deveraux, who said Marks exploited her during a vulnerable time in her life.

Victims said Marks, who operated out of storefronts in Fort Lauderdale’s tourism district, convinced them that she had special powers, including swapping people’s souls between bodies, preventing a woman from conceiving a child, and preventing the IRS from pursuing clients for back taxes.

Rose is serving a 10-year prison sentence. Eight of her family members were also convicted.

And then there was Miss Cleo. Longtime readers will remember that Broward County was home base for the late-night television psychic played by Youree Dell Harris and the company that paid her to invite viewers to “call me now for your free reading.”

Trouble was, there was no free reading. Callers were directed to call another number charging $4.99 a minute. Accused of bilking callers out of $1 billion, operators of the Psychic Readers Network agreed to credit $500 million back to customers, and Miss Cleo faded into obscurity before dying of cancer in 2016 at age 53.

Call center schemes

With its vast labyrinth of office park space, South Florida has spawned some legendary call center scams.

Recently, call centers operating out of Boca Raton and Pompano Beach have been targets of enforcement actions by the Federal Trade Commission. These include a debt relief marketing scheme operating under a dozen different names in Pompano Beach accused in May 2017 of scamming 15,000 mostly disabled or elderly consumers out of more than $50 million.

That same month, the FTC shut down a student loan relief operation in Boca Raton, charging that the company scammed more than 20,000 customers out of as much as $25 million to $30 million over five years.

Around the same time, the FTC stopped another Boca Raton-based call center. This one caused pop-up ads to appear on computers belonging to elderly users that warned the computers were infected with viruses. When the computer owners called phone numbers on the ads, they were sold expensive repair services, service plans and anti-virus protections, the FTC said.

As long as office space is available, prospects for call center scams endure. In November 2017, the court-appointed receiver tasked with liquidating remaining assets of the Pompano Beach debt relief operation listed its office building for sale. A marketing kit produced by the real estate broker handling the sale declared it would be ideal as a “plug and play call center space.”

Immigration fraud

Undocumented immigrants afraid to seek help from authorities make ideal victims for scammers promising to help them attain legal status.

In 2012, a Broward County husband and wife pleaded guilty and were sentenced to lengthy prison terms for operating a reported religious organization that promised to secure so-called religious worker status for more than 1,400 illegal immigrants, each of whom paid an average $6,800 in fees or “donations.”

The couple operated out of a Plantation strip mall and the Swap Shop flea market, the Sun Sentinel reported.

That same year, the owner of a Margate-based staffing company was sentenced to prison for recruiting 145 Haitians to the United States with promises of construction jobs, hotel rooms in South Florida and the possibility of legal residency. Instead the woman, also Haitian, shipped some of the workers to farm fields near Gainesville, where they lived in filthy trailers with no electricity. Others were sent to South Carolina.

Identity theft

South Florida held the top spot for per-capita rate of identify theft complaints for five straight years, from 2010 to 2015, in the Federal Trade Commission’s Consumer Sentinel Network Data Book.

Ways in which fraudsters obtain our identities are constantly increasing, as are the ways they make money off of our personal information. In addition to databases of credit card information available for purchase on the so-called “dark web,” identifying information is brokered by employees and former workers at hospitals, medical schools, restaurants, government and human resource departments, authorities say.

They use our stolen identities to steal our income tax refunds, open and run up credit cards, and even steal unemployment and Social Security benefits. In September 2017, Evelina Sophia Reid, a former secretary for Jackson Health System, was sentenced to 56 months in federal prison for accessing company databases and stealing personally identifiable information of more than 24,000 patients, which her co-conspirators used to file fraudulent tax returns and unemployment insurance claims.

Reid was among 104 defendants charged in 81 cases involving more than 30,000 individuals. In announcing the charges in February 2017, U.S. Attorney Wifredo Ferrer called South Florida the “epicenter of identity theft.”

The problem is so pervasive in South Florida that local, state and federal officials formed the South Florida Identity Theft Fraud Strike Force in 2012 to try to stem the flow of tax refund scams.

Hurricane fraud

Fraudsters scurry out of the shadows in the wake of every major hurricane:

Unlicensed contractors show up at victims’ damaged homes and take advance payments to fix holes in roofs or cart away fallen trees but never return. Shysters pose as public insurance adjusters, collect money to help homeowners file hurricane claims and then disappear. Opportunists steal Federal Emergency Management Agency assistance money by falsifying damage or hardship claims.

But these are small-time grifts compared with the hall-of-fame swindlers who spin their wheels while the rest of us install our shutters and stock up on batteries.

After Hurricane Katrina devastated the Gulf Coast in 2005, an Aventura man was busy soliciting donations online with false claims he was flying relief flights to evacuate victims from Louisiana, prosecutors said. He collected nearly $40,000 in two days with fictitious claims including that he flew a 7-month-old girl to South Florida for urgent transplant surgery.

Court documents said 48 people donated money to the man, thinking they were helping to fund additional relief flights. He pleaded guilty in January 2006 to federal wire fraud.

In 2006, a former FEMA inspector pleaded guilty and was sentenced to a year in prison for taking kickbacks to sign off on false damage claims in Miami-Dade County after Hurricane Frances.

In 2005, Lake Worth-based Chuck’s Discount Appliance and TV agreed to pay $11,100 in restitution to settle a complaint by the state Attorney General’s Office that the company bought 86 generators from local Costco stores and resold them to consumers at prices 32 percent to 55 percent above their retail value during Hurricane Jeanne the year before.

And in an odd case, Coral Gables resident Emilio Vazquez of Coral Gables pleaded guilty in April 2018 to a strange scam in which he claimed to be a wealthy member of the family that owns the Don Q rum distillery and was organizing private flights of relief supplies for victims of Hurricane Maria in Puerto Rico the previous October.

A twice-convicted felon, Vazquez gave counterfeit checks and fraudulent wire transfers totaling nearly $700,000 to a warehouse and cargo flight operator, both in Doral — ostensibly to store and ship the donated goods.

While authorities didn’t accuse Vazquez of having a financial motive, he played the role of Good Samaritan for more than a week, reaping praise from Ellen DeGeneres and Bethenny Frankel on live television, and traveling to Puerto Rico on one of his charter flights with recording artist Olga Tañon and a Telemundo anchor.

Vazquez was sentenced to 10 years in prison and ordered to pay $1 million in restitution.

Ron Hurtibise- Contact Reporter, South Florida Sun Sentinel

http://www.sun-sentinel.com/business/fl-bz-south-floridas-sickest-scams-20180823-story.html

October 2, 2018