Category Archives: False Claims Act

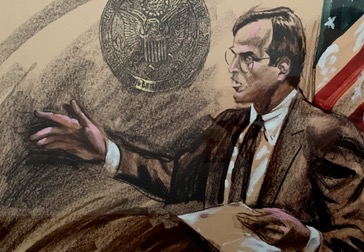

Government signals sea change on health care false claims

The U.S. Department of Justice announced a major change in its policy regarding qui tam litigation in October. Moving forward, DOJ will now file a motion to dismiss when it decides a qui tam case is without merit rather than allowing the relator to proceed on his or her own. The announcement, made by… Read More »

DoJ Settles $27.68M in Medicare Fraud, False Claims Act Violations

The Department of Justice continues its crackdown on Medicare fraud by settling various criminal cases related to $27.68 million of False Claims Act violations. Provider settlements remain the primary medium for healthcare fraud recoveries, according to recent data released by the Office of the Inspector General (OIG). Settlements helped law enforcement officials recover $1.1… Read More »

Tax Reform Impacts Resolutions of False Claims Act Enforcement Actions

The tax reform law passed in December 2017 establishes requirements and conditions for the tax deductible treatment of payments made to the government to resolve enforcement actions. See 26 U.S.C. § 162(f) (2018); see also Pub. L. No. 115-97, § 13306, H.R. 1 (Dec. 22, 2017). The new provisions hold important implications for defendants… Read More »