What to Do if You’re Arrested for Tax Fraud in Florida

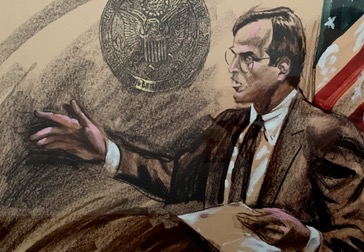

Are you under investigation for problems with your tax reporting? Are you facing potential charges for tax fraud or tax evasion in Florida? Tax fraud is a federal crime, which means you are under investigation by the IRS. Federal crimes are different than state crimes. With state-level crimes, you are often arrested and then the investigation ramps up. With federal crimes, the government often has a lot of evidence against you already when you are arrested.

You should not take any potential criminal charge against you lightly. This is especially true if you are facing federal charges. You need a Florida tax fraud attorney who has experience with these types of cases. The federal government has ramped up their prosecutions of white collar crimes, which is what tax evasion and tax fraud fall under.

Overview of Federal Tax Evasion and Fraud

Tax fraud can be committed by both individuals and businesses. It can be intentional, or it can be accidental. The government may decide to pursue tax fraud either criminally or civilly. There has been a trend to push for criminal prosecutions. You might be facing criminal charges while the government pursues your business in a civil case.

The IRS is not only who you pay taxes to, but it’s also the exclusive agency that investigates tax-related crimes. They employ thousands of agents who are tasked with detecting, preventing, and investigating tax crimes and fraud. This can include identity theft as it relates to taxes.

You may be told there is a charge for conspiracy as well, which is not uncommon with tax crimes either. When they add conspiracy charges, it’s because the government believes you agreed with one or more other parties to commit tax fraud.

Examples of Federal Tax Crimes

To better understand federal tax crimes, here’s a look at two of the most common charges:

- Tax evasion: Tax evasion is when you knowingly underreport your income with the purpose of avoiding making payments you owe. Just filing a return doesn’t mean evasion, it has to be a willful act to misreport your income. An accidental oversight or miscalculating does not rise to the level of tax evasion.

- Making a false statement on your tax returns: If you purposely sign and submit a tax return that has statements you know are false, it could result in criminal charges. The false statement would need to be a material omission that could influence an IRS investigation, audit, or income verification.

Penalties for Federal Tax Crimes

Criminal penalties for tax crimes typically involve prison sentences, hefty fines, and the requirement that you repay the government for prosecution costs. If you receive civil penalties, these come in the form of fines, penalties, and a bill for the government’s prosecution costs.

Do not take a charge for tax fraud lightly. Tax evasion could result in a fine of up to $100,000 for individuals, $500,000 for corporations, and even a prison sentence of up to five years. If you have been indicted or are under investigation, don’t delay. Contact a Fort Lauderdale white collar crime attorney at the office of Bruce L. Udolf, P.A. today to schedule an initial consultation.

https://www.bruceudolf.com/what-to-do-if-you-are-charged-with-health-care-fraud-in-florida/