Panama Papers: Miami Beach fraudsters hid loot in offshore companies

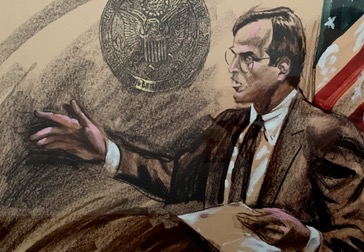

Among the many questionable customers of Panamanian law firm Mossack Fonseca were a Miami Beach father and son convicted of a $49 million tax fraud in 2011. Mauricio Cohen Assor, 82, and Leon Cohen-Levy, 51, hid a Miami Beach mansion, a Fisher Island condo, bank accounts, luxury cars and even a helicopter from the Internal Revenue Service. They were each sentenced to 10 years.

Leaked files from Mossack Fonseca, which sets up offshore companies for the rich and powerful, show that the firm established at least 13 offshore companies for the Cohens. Federal prosecutors in Miami said Cohen Assor used one of those companies, a Panamanian entity called Blue Ocean Finance, to hide $33 million he made from selling a luxury high-rise tower, the Flatotel Hotel, in New York City in 2000.

The Cohens also hid income, including a $45 million investment portfolio, in a Mossack Fonseca company called Whitebury Shipping Time-Sharing, registered in the British Virgin Islands, according to the federal case. It’s legal to own an offshore company. Offshore havens such as Panama and the British Virgin Islands don’t force company owners to reveal their names. That makes them a prime destination for those looking to commit fraud, money laundering and other illicit acts.

The Cohens’ tax fraud came out after a French lender accused them of pocketing a loan meant to renovate the hotel.

“The Cohens were clients of Mossack Fonseca and abused the anonymity provided by these offshore corporations for years,” said Scott Cosgrove, a Coral Gables attorney representing the lender, a French government entity called CDR. “Money designated to pay CDR was diverted to Swiss Bank accounts owned by these secretive entities. It made our efforts to recover the misdirected proceeds incredibly difficult, and having access to these papers would have certainly smoothed the road to recovery. To the extent others have used Mossack Fonseca to create corporations for improper purposes, they have reason to be deeply concerned.” The Cohens’ nine-bedroom waterfront mansion at 5930 North Bay Rd., Miami Beach, is now being listed for $29.5 million. The proceeds will go to the Cohens’ creditors.

Cohen-Levy also planned to build a 93-story tower in downtown Miami. Mossack Fonseca said it does not comment on individual cases. Through thick and thinLeaked emails between Mossack Fonseca employees show that the firm was still acting as the registered agent for the companies in May 2015 — four years after the Cohens were convicted. The firm initially didn’t seem to know that the Cohens owned the companies, which had been set up at the request of a Swiss lawyer, André Zolty, in the late 1990s, according to the records. But the last email in the file shows that Mossack Fonseca finally resigned in July 2015, at least for the companies named by the feds, citing the Cohens’ criminal convictions. It stayed on for the others.

http://www.miamiherald.com/news/local/community/miami-dade/article69249657.html

By Nicholas Nehamas