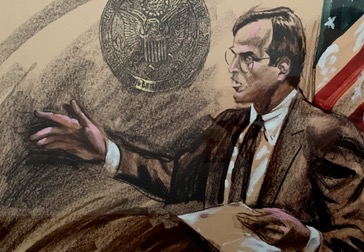

Federal Grand Jury Indicts Ex-Chairman of Public Health Trust on Grounds of Tax Evasion, Fraud

While he campaigned for an $830 million bond referendum paid for by Miami-Dade taxpayers in 2013, the then-board chairman of Jackson Health System, the county’s public hospital network, refused to pay personal income taxes and then dodged the IRS’s collection efforts, a Miami grand jury said in a criminal indictment unsealed last week.

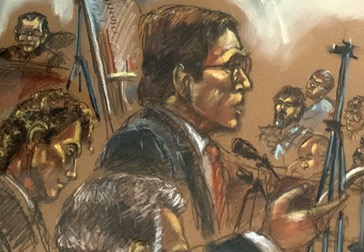

Darryl Sharpton, who served as chairman of the Public Health Trust that manages Jackson Health from 2013 to 2015, was charged by the grand jury with tax evasion and fraud. He could not be reached at his office or on his mobile phone Tuesday, and did not respond to an email request for comment.

A certified public accountant and founder of a financial management firm, The Sharpton Group, Sharpton was appointed to Jackson’s board of trustees in May 2011 as part of a financial recovery team to steer the hospital system out of near bankruptcy. He stepped down from the seven-member board in 2016 after completing his term.

Under Sharpton’s leadership in 2013, Jackson Health successfully campaigned for Miami-Dade voters to approve a referendum to raise their property taxes and fund $830 million in upgrades and new equipment and facilities for the hospital system.

That year, Sharpton refused to file a personal income tax return — just as he had refused to file in 2009, and from 2011 to 2016, according to the indictment.

From 2004 through 2008 and in 2010, Sharpton filed personal income tax returns but failed to pay the taxes that he owed for those years, the grand jury alleged.

When the Internal Revenue Service garnished Sharpton’s wages in 2007, the indictment said, he removed himself from The Sharpton Group’s payroll to evade the penalty.

Sharpton later put himself back on the payroll, but doctored his W-2 and wage statements to make it appear that “a substantial amount” of payroll taxes were withheld from his paycheck, according to the indictment. But the grand jury said Sharpton knew those payroll taxes were not being turned over to the IRS.

After the IRS tried to collect from Sharpton again in 2013, he took himself off the payroll a second time and began to pay his personal expenses through The Sharpton Group’s corporate bank account, the indictment alleged.

In all, the indictment charged Sharpton with failing to pay the IRS nearly $1 million in payroll taxes withheld from “employees of The Sharpton Group,” though it’s unclear from the document how many workers that amount represents.

The grand jury’s indictment of Sharpton was unsealed four days before the April 17 deadline for Americans to file their 2017 federal income tax returns — part of a Justice Department tradition of spotlighting tax evasion cases near Tax Day.

If convicted, Sharpton faces a maximum sentence of five years in prison for the tax evasion charge, five years in prison for each count of failing to pay payroll taxes, and one year in prison for each count of failing to file tax returns, the Justice Department said.

By Daniel Chang

April 17, 2018Read more here: http://www.miamiherald.com/news/health-care/article209103589.html#storylink=cpy