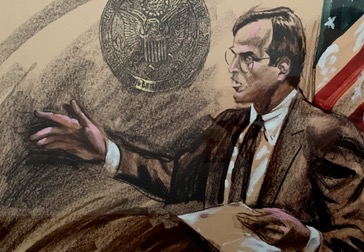

The Morning Risk Report: C-Suite on Hot Seat Over Bribery, Study Says

Senior executives are in the cross-hairs as the U.S. continues to crack down on individuals in corporate bribery cases, according to research published this week by a law firm.

More than half of the people charged with violating the nation’s foreign-bribery law in the past 13 years worked near the top of the corporate tree, Arent Fox LLP found. The Justice Department charged 20 individuals with violations of the Foreign Corrupt Practices Act in 2017, the second-highest total since the law was passed in 1977, according to the report.

Thirty-three people were charged in 2010, Arent Fox said, but that total includes 22 individuals, charged in a Federal Bureau of Investigation undercover operation, whose cases were later dismissed by a court.

“Our study shows the federal government is continuing to intensify its FCPA focus on individuals–not just through policy memoranda and press releases but through actual investigations and enforcement actions,” said M. Scott Peeler, co-head of Arent Fox’s government enforcement and white-collar group.

The research tracked all individuals charged with violating the FCPA by either the Justice Department or the Securities and Exchange Commission from the start of 2005 through the end of 2017. It found that 53% of the 180 people charged worked as chief executive officer, president, vice-president, managing director or director in their corporation.

From the start of 2005 through 2010, five CEOs faced civil or criminal charges, amounting to 6% of the 82 people charged. Thirteen were charged from 2011 through 2017, 13% of the 98 individuals the Justice Department or SEC went after, data included in the report show..

The figures exclude the 22 enforcement actions related to the 2010 FBI probe. A court permanently dismissed those actions in 2012.

“Enforcement agencies have encouraged a risk-based approach to compliance for years,” said Mr. Peeler. “Well, the risk to individuals is real, and companies should act accordingly.”

People charged in cases where the total bribes paid were less than $100,000 accounted for 6% of the number of individuals targeted, while matters with a total payment of more than $100 million comprised 5%. Cases involving total bribes of between $1 million and $10 million accounted for 45%.

Even the smallest bribery cases are likely to lead to criminal prosecutions, according to the report. Only one individual faced civil charges in a matter involving total bribes of less than $100,000; nine people were prosecuted criminally.

“It can be low-level bribes and you can still be prosecuted criminally,” said Mr. Peeler. “The trip point is actually lower than you might think.”

EXCLUSIVE ON RISK AND COMPLIANCE JOURNAL

More than half of the 150-odd U.S. public companies targeted by a push for greater diversity on boards have improved their processes or disclosure, New York City Comptroller Scott Stringer and the New York City Pension Funds said Wednesday.

U.S. sentences Aruban official to prison in bribery case. An Aruban official living in Florida was sentenced to three years in prison after he pleaded guilty to money-laundering charges connected to his role in a bribery scheme, prosecutors said.

Egbert Yvan Ferdinand Koolman admitted when pleading guilty that he had received $1.3 million in bribes over the course of a decade in exchange for using his position to award mobile-phone and accessory contracts. A second man, Lawrence Parker Jr. of Miami, pleaded guilty to foreign bribery charges in the case, and was sentenced in April to 35 months in prison.

Mr. Koolman conspired with Mr. Parker and others to transmit funds from the U.S. to Aruba and Panama as part of the scheme, prosecutors said. –Samuel Rubenfeld

COMPLIANCE

U.S. regulators are pressing internet companies to do more to prevent online sales of opioids as industry leaders met with government officials Wednesday. Food and Drug Administration chief Scott Gottlieb said the “easy availability of opioids online” has become “a major public health concern.”

Industry rarely seeks more regulation, but a marijuana startup sees national rules as key to the future of the pot business. The National Association of Cannabis Businesses wants to help its members navigate balkanized rules from states, counties and cities by providing the closest thing it can to unified national regulation, even as pot remains illegal at the federal level, the WSJ reports.

DATA SECURITY

Equifax must improve how it manages cybersecurity risk, regulators from eight states said Wednesday, responding to a 2017 data breach that exposed the personal data of nearly 148 million consumers, the WSJ reports.

California’s legislature is to vote Thursday on legislation that would force tech companies to disclose the types of data they collect about consumers as well as the entities, such as advertisers, they share the information with, the Washington Post reports.

GOVERNANCE

Sempra Energy is selling its wind and solar assets in the U.S., along with some natural-gas assets, it said Thursday. The news comes less than a month after activist investor Elliott Management Corp. and Bluescape Resources Co. said they owned a 4.9% stake and criticized Sempra for being too interested in “sheer size,” the WSJ reports.

RISK

Justice Anthony Kennedy announced his retirement, setting the stage for a battle over the U.S.’s constitutional direction and handing President Donald Trump the chance to cement the Supreme Court’s conservative course for years to come, the WSJ reports.

U.S. President Donald Trump, in withdrawing threats to impose new restrictions on Chinese investment, instead put his faith Wednesday in Congress, which is advancing its own legislation to toughen national security reviews of foreign deals, the WSJ reports.

Apple and Samsung Electronics have quietly settled a dispute over Apple’s design patents, ending a yearslong fight. The companies declined to comment on the terms of the out-of-court settlement, the WSJ reports.

PetSmart Inc. and its parent holding company sued Citibank NA, in an escalation of a fight between the retailer and a group of lenders over the transfer of shares in PetSmart’s Chewy.com e-commerce unit, the WSJ reports.

OPERATIONS

Leaders at U.S. ports say trade tensions could drive down cargo volumes and hit businesses that depend on the flow of goods. Economists say the impact could spread beyond the specific categories of imports and exports that may be subject to tariffs, the WSJ reports.

U.S. companies are holding back payments to their suppliers for longer than at any point in the past decade, a push that is helping them keep more cash on hand, according to a study to be released next month by consulting firm The Hackett Group, the WSJ reports.

STRATEGY

Amazon.com is pushing further onto the turf of its shipping partners United Parcel Service Inc. and FedEx Corp. , enabling small businesses to carry its overflowing supply of packages in the all- important leg to the consumer’s door, the WSJ reports.By: Henry Cutter Jun 28, 2018

https://blogs.wsj.com/riskandcompliance/2018/06/28/the-morning-risk-report-c-suite-on-hot-seat-over-bribery-study-says/