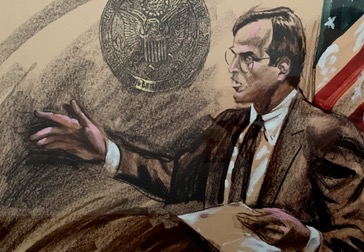

Is it a felony to fail to file an income tax return?

Return to FAQsTranscript:

Generally speaking, failure to file an income tax return is a misdemeanor offense. It can be a felony if there is evidence that the failure to file is willful. Well what does that mean in English? Well, generally the IRS requires some affirmative evidence that failure to file is part of a scheme to conceal and defraud, conceal evidence and defraud the IRS.