‘A Mickey Mouse Operation’: How Panama Papers law firm dumped clients, lost Miami office

Mossack Fonseca’s secrets had just been spilled to the world — and clients of the Panamanian law firm’s Miami office were furious.

“You guys had employees arrested in my country because your firm accepts deals with corrupt companies and corrupt politicians in Brazil,” Luis Paulo Mesquita, a São Paulo financier with an offshore company set up by MF, wrote in an April 2016 email to the firm’s employees. “And now, this stupid scandal called Panama Papers!”

The Panama Papers — a partnership between 100 media organizations around the world that analyzed 11.5 million secret Mossack Fonseca documents — exposed the dodgy world of offshore companies, where kleptocrats, drug lords and tax cheats hide their riches scot-free. The 2016 leak also put an unwelcome spotlight on wealthy clients of the firm like Mesquita who had done nothing wrong but sought privacy for their financial affairs.

“I do not want to do business with Mossack anymore,” wrote Mesquita, who didn’t respond to a recent request for comment. “The guys you consider as clients do not have the same ethics standards I have.”

Now, a new leak of documents from the since-shuttered law firm shows what happened as MF employees struggled to contain the fallout from the scandal — and distance the firm from clients accused of criminal behavior.

The new leak of documents spans the period from March 2016 — just before journalists published the Panama Papers — through the end of 2017, a few months prior to the firm collapsing. MF had many unhappy customers to placate.

Because of the Panama Papers, “all the names of our customers have been known by the authorities of their countries.,” Meir Elmaleh, a Geneva-based fund manager, told MF employees in an email last year. “Thanks to Mossack, customers have to pay income taxes.”

As with the first set of records, which covered the late 1970s to 2015, the new documents were obtained from a confidential source by the German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists, a Washington, D.C-based group of journalists that partners with the Miami Herald and its parent company, McClatchy.

The new documents reveal that Mossack Fonseca couldn’t identify tens of thousands of owners of companies it had registered in opaque, low-tax jurisdictions. Two months after the firm became aware of the records breach, it still couldn’t identify owners of more than 70 percent of 28,500 active companies in the British Virgin Islands, the firm’s busiest offshore hub, and 75 percent of 10,500 active shell companies in Panama, the records show.

The firm’s ignorance about who benefited from the shell companies it helped set up represented a significant risk. So-called know-your-client rules obligate financial institutions to know who they’re doing business with — and what they’ve done in the past. Offshore companies have many legal purposes, but they are easy to misuse because of their secrecy. It can often be impossible to tell who really owns such companies.

Back in 2016, the Herald — armed with leaked corporate registries that showed for the first time the true owners of thousands of secret shell companies — approached MF with questions about some of its clients’ alleged ties to wrongdoing. Those ties were hiding in plain sight in public records and news reports.

At that time, the law firm said its due diligence practices were of the highest standard.

But the newly leaked internal documents show that almost immediately after reporters contacted MF, the firm told those clients it would resign as the registered agent for their offshore companies.

In many cases, MF employees even filed “suspicious activity reports” with regulators, saying the clients posed a risk of money laundering or criminal behavior.

It should have been obvious: Reporters often found damaging information through simple Google searches and reviews of court records. But the firm seems not to have taken the information seriously until reporters came knocking.

Whether the firm didn’t perform due diligence on its clients — or knew about the information and didn’t care — isn’t always clear.

Either way, MF was “turning a blind eye,” said Shruti Shah, president and CEO of the Coalition for Integrity, a Washington, D.C.-based anti-corruption advocacy group.

Days after the Panama Papers were published, MF began frantically reaching out to clients for documents and information it should have already had, the new documents show. That led to tension with the lawyers who brought clients to MF and represented them in the back and forth.

“This has been ridiculous,” wrote Eliezer Panell, a Doral lawyer who grew exasperated at Mossack Fonseca’s multiple requests — sometimes only one day apart — that he obtain and share documents from two offshore company owners to prove their identity.

“WE CAN’T GO BACK a day after asking for papers to ask for something else. WE LOOK LIKE F—KING AMATEURS,” he wrote, spelling out the expletive. “A Mickey Mouse operation.”

Shah said she believes MF’s helter-skelter practices reflect the practices of the broader multibillion-dollar offshore industry.

“I don’t think Mossack is an outlier,” she said. “This is pretty much how the offshore industry operates.”

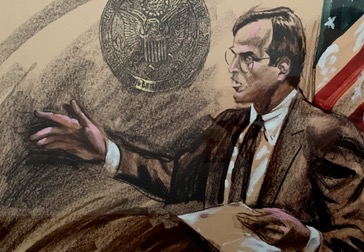

Partners of the Panama-based law firm Mossack Fonseca, Ramon Fonseca and Jurgen Mossack, left and right.Arnulfo Franco, Handout AP, ICIJ

Partners of the Panama-based law firm Mossack Fonseca, Ramon Fonseca and Jurgen Mossack, left and right.Arnulfo Franco, Handout AP, ICIJ

In 2017, ICIJ and news partners published the Paradise Papers, a similar leak that showed how Appleby, one of the world’s most important offshore firms, used financial havens to help its clients avoid taxes, a legal practice but one that raise questions of fairness and whether such loopholes perpetuate income inequality.

MF said it would shut down in 2018 following the arrest of its founders, Jürgen Mossack and Ramon Fonseca, in Panama a year earlier on money-laundering charges.

“They have their fight, and as a lawyer I plan to demonstrate their innocence,” Guillermina McDonald, a lawyer representing the men, said in a recent interview. “I want to have the opportunity to demonstrate that they have not committed any crime.”

In the shadows

Mossack Fonseca served some of the world’s wealthiest people, setting up offshore companies in opaque jurisdictions like the British Virgin Islands and the Seychelles, an assortment of islands in the Indian Ocean.

The firm offered its services to cronies of Russian President Vladimir Putin and Syrian leader Bashar al-Assad; the brutal Guadalajara cartel boss Rafael Caro Quintero; Brazilian officials tied to the massive Lava Jato money-laundering scandal; the personal secretary of Argentina’s former president; and a Venezuelan national convicted in the United States over a spying scandal.

MF consistently failed to vet its clients in accordance with global rules that prevent financial firms from providing services to people who may be connected to criminal behavior, according to a review of the secret files.

One MF client, for instance, was Paulo Octávio Alves Pereira, a Brazilian developer and the former deputy governor of the state of Brasilia.

After the governor, José Roberto Arruda, was filmed accepting what authorities said was a cash bribe in 2009 and resigned, Octávio took his place.

Information on the scandal was publicly available — but MF somehow didn’t discover it when setting up his offshore company in the British Virgin Islands in 2011.

It was only two years later that employees stumbled on the corruption allegations, leading them to classify Octávio as a “politically exposed person” whose financial transactions deserved heightened scrutiny, according to the firm’s internal standards. Still, MF didn’t drop him as a client.

No one inside the firm acted until the Miami Herald sent an email to MF on March 25, 2016, asking questions about Octávio and other clients.

The firm responded by writing in an email: “We conduct thorough due diligence on all new and prospective clients that often exceeds in stringency the existing rules and standards to which we and others are bound.”

But six days later, MF sent Octávio a letter saying it planned to resign from his offshore company, which he had used to secretly purchase a $3 million condo in Bal Harbour.

The firm went a step further: It also filed a suspicious activity report with regulators in the British Virgin Islands.

According to the report, MF said it suspected Octávio of “money laundering” and “crime/fraud,” even though Octávio had declared his company to Brazilian authorities and paid taxes.

The firm cited several Brazilian newspaper stories covering his political career, a 2014 arrest and charges of money laundering..

But within 12 days Octávio was forced from office, too.

Information on the scandal was publicly available — but MF somehow didn’t discover it when setting up his offshore company in the British Virgin Islands in 2011.

It was only two years later that employees stumbled on the corruption allegations, leading them to classify Octávio as a “politically exposed person” whose financial transactions deserved heightened scrutiny, according to the firm’s internal standards. Still, MF didn’t drop him as a client.

No one inside the firm acted until the Miami Herald sent an email to MF on March 25, 2016, asking questions about Octávio and other clients.

The firm responded by writing in an email: “We conduct thorough due diligence on all new and prospective clients that often exceeds in stringency the existing rules and standards to which we and others are bound.”

But six days later, MF sent Octávio a letter saying it planned to resign from his offshore company, which he had used to secretly purchase a $3 million condo in Bal Harbour.

The firm went a step further: It also filed a suspicious activity report with regulators in the British Virgin Islands.

According to the report, MF said it suspected Octávio of “money laundering” and “crime/fraud,” even though Octávio had declared his company to Brazilian authorities and paid taxes.

The firm cited several Brazilian newspaper stories covering his political career, a 2014 arrest and charges of money laundering..

The former governor of Brasilia, José Roberto Arruda, (left) and his deputy, Paulo Octávio, (right) were forced to resign after a corruption scandal several years ago.

The former governor of Brasilia, José Roberto Arruda, (left) and his deputy, Paulo Octávio, (right) were forced to resign after a corruption scandal several years ago.

Octávio, who is still in court battles over the allegations, did not respond to requests for comment this past week. He previously denied all wrongdoing and is now planning to seek election to Brazil’s Senate, according to local media reports.

MF also said it would resign and filed SARs on companies owned by seven other clients flagged by the Herald.

Many had used their offshore companies to buy properties in the United States. The flow of secret foreign money into hot property markets like Miami is one reason local workers struggle to afford homes.

Miami office

The publication of the Panama Papers also spelled trouble for Olga Santini, who represented Mossack Fonseca in Miami.

From a two-bedroom condo on Brickell’s waterfront, Santini steered wealthy individuals to MF’s main office in Panama and acted as a go-between for MF employees and the clients’ outside lawyers. Although she was not an MF employee, the company’s website referred to her as the head of its Miami office and she often used an MF email address.

A global scandal was not good for her business.

Brasilia, José Roberto Arruda, (left) and his deputy, Paulo Octávio, (right) were forced to resign after a corruption scandal several years ago.

Two months after the Herald and its news partners published the Panama Papers, Santini shut down her firm M.F. Consult and began doing business with MF exclusively as Prime Keys Solution.

Still, some clients fled.

“I am Prime Keys Solutions, not Mossack Fonseca,” Santini told a worried client last year in one recently leaked email.

“The fact is that we are all over the Panama Papers,” the client, Peter Marlowe, who wanted to sell a property in Key West, wrote back. “We have had a really good relationship, but all things must pass.”

Santini did not respond to a request for comment.

Similarly, an employee at a Miami law firm representing Chilean businessman Rene Kreutzberger — the brother of Spanish-language television star Don Francisco — told MF that “due to the Panama Papers [Kreutzberger] would like to close” his offshore company.

It was a problem worldwide. Clients didn’t think they could trust MF anymore.

“Because of the ‘Panama Papers’ incident, we have great reservation to provide your company further personal records … of our directors,” one client in China wrote.

Alan Lips, a partner at Miami accounting firm Gerson Preston who works with wealthy clients offshore, said that was a natural reaction. Security is a major concern for the global elite.

What is Panama Papers 2.0?

A new leak at the Mossack Fonseca law firm in Panama exposes how it and its clients reacted to the 2016 release of the Panama Papers.

The new leak: Munich’s Süddeutsche Zeitung newspaper was given the new files, which were shared with the International Consortium of Investigative Journalists.

Its size: 1.2 million files, roughly 1/10th of the original 2.6 terabyte leak of 11.5 million files.

Media partners: More than 100 journalists across globe, including a McClatchy/Miami Herald team.

http://www.miamiherald.com/latest-news/article213423514.html

BY NICHOLAS NEHAMAS